Coinspeaker

Ethereum Price Analysis: Bulls Target $4,000 as ETF Inflows Resurface

As Bitcoin

BTC

$102 412

24h volatility:

1.9%

Market cap:

$2.03 T

Vol. 24h:

$44.47 B

trades close to the $104,000 mark, Ethereum

ETH

$3 299

24h volatility:

1.7%

Market cap:

$397.64 B

Vol. 24h:

$30.83 B

continues to get better. Yesterday, Ethereum value surged by 4.29% to succeed in a closing value of $3,247.

With two consecutive days of constructive development, Ethereum is making ready for a falling-wedge breakout rally. Will this breakout rally end in a value surge past the $4,000 mark? Let’s discover it.

Ethereum Worth Crosses $3,200: Bulls to Problem Native Resistance

Within the every day chart, the Ethereum value pattern reveals a bullish comeback from the native help pattern line. This ends in a morning star sample with the bullish engulfing candle from yesterday.

Moreover, it marks a constructive cycle inside a falling-wedge sample. Rising the possibilities of a breakout rally, the reversal rally in Ethereum has reached the $3,250 psychological mark.

Able to problem the overhead resistance line, the technical indicators are beginning to give a purchase sign for Ethereum. The MACD and sign strains have given a constructive crossover.

Moreover, the true power index is on the same map to present a purchase sign. The possibilities of Ethereum getting a breakout rally are considerably elevated.

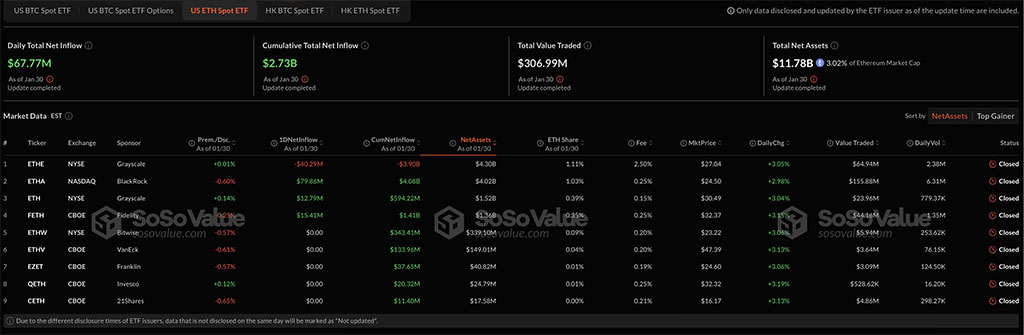

ETF Inflows Hit $67M: Drives the Ethereum Rally

Amid the growing possibilities of a bullish breakout, the sudden restoration in Ethereum comes with the newfound institutional help. On January 30, three main Ethereum ETFs bought ETH value greater than $100 million.

Nevertheless, the every day internet influx remained at $67.77 million. BlackRock, the most important purchaser, on January 30 acquired $79.86 million value of ETH.

Following their footsteps, Constancy bought $15.41 million and Grayscale bought $12.79 million. Nevertheless, the Grayscale mini-Ethereum belief offloaded $40.29 million, pulling again the every day internet influx.

Presently, the whole internet property underneath the Ethereum ETFs stand at $11.78 billion. The Ethereum ETFs are anticipated to begin a brand new shopping for spree.

Rising Whale Curiosity Hints Uptrend Forward

As the value motion evaluation and institutional inflows undertaking a possible bull rally, the curiosity from the facet of whales is rising. In a latest X put up by Ali Martinez, the stability by holder worth witnesses a big improve.

Whales purchased over 100,000 #Ethereum $ETH through the latest value dip! pic.twitter.com/q2iHx2aIO8

— Ali (@ali_charts) January 30, 2025

The info from CryptoQuant highlights the whales buying over 100,000 ETH tokens through the latest dip. Moreover, in a big transaction, a whale purchased 1,531 ETH tokens value 5.01 million USDC

USDC

$1.00

24h volatility:

0.0%

Market cap:

$53.32 B

Vol. 24h:

$6.32 B

.

The acquisition occurred at a mean value of $3,277. Moreover, the bullish whale at the moment holds 3,005 ETH value $9.85 million, with its holding divided into two completely different wallets. The whale exhibits excessive confidence over Ether’s future.

In a nutshell, with robust institutional inflows, bullish technical indicators, and growing whale accumulation, Ethereum is well-positioned for a breakout. If it breaches the falling wedge resistance, a rally past $4,000 might be imminent. Thus, it makes the approaching days essential for the ETH value motion.next

Ethereum Price Analysis: Bulls Target $4,000 as ETF Inflows Resurface