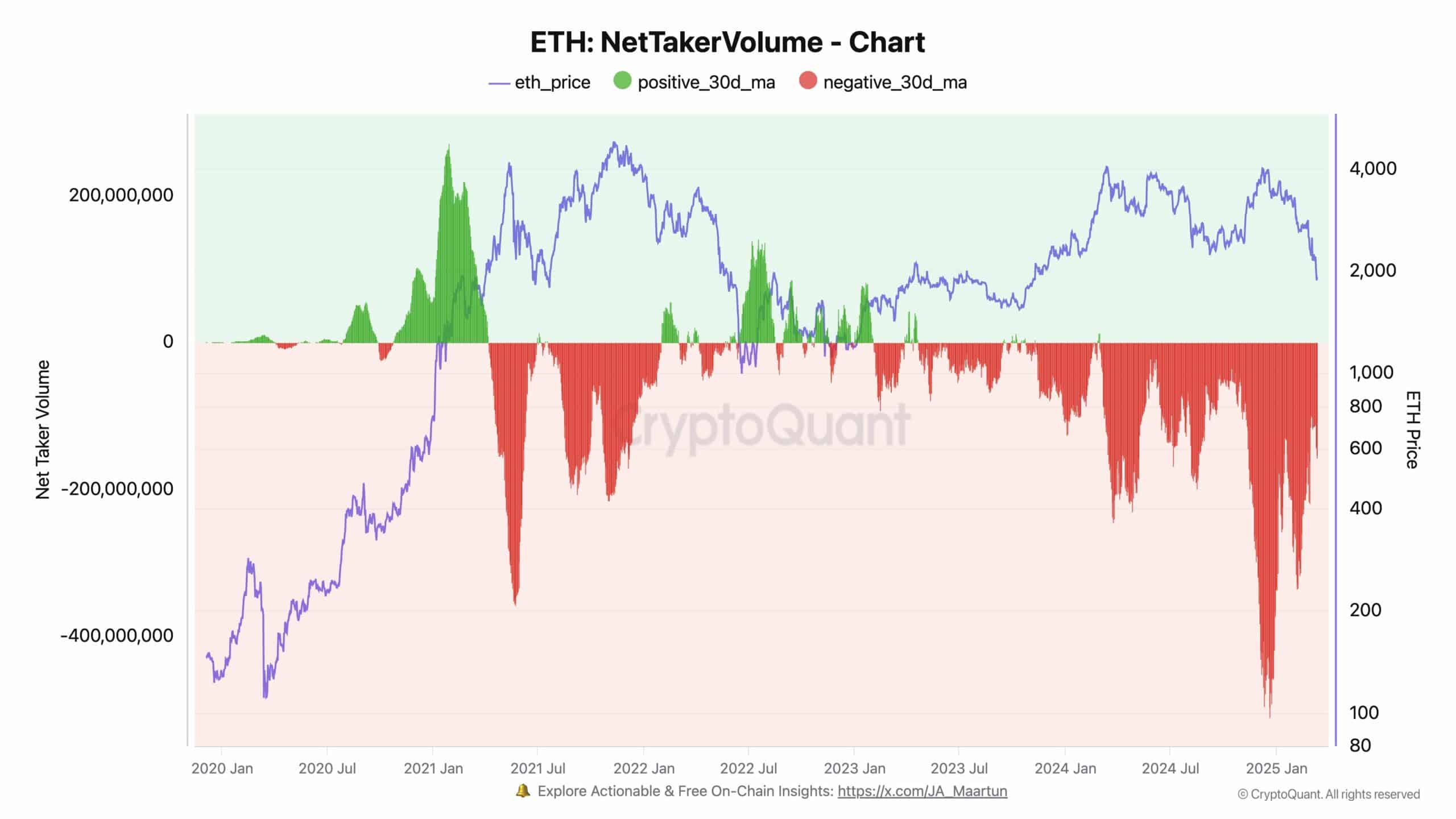

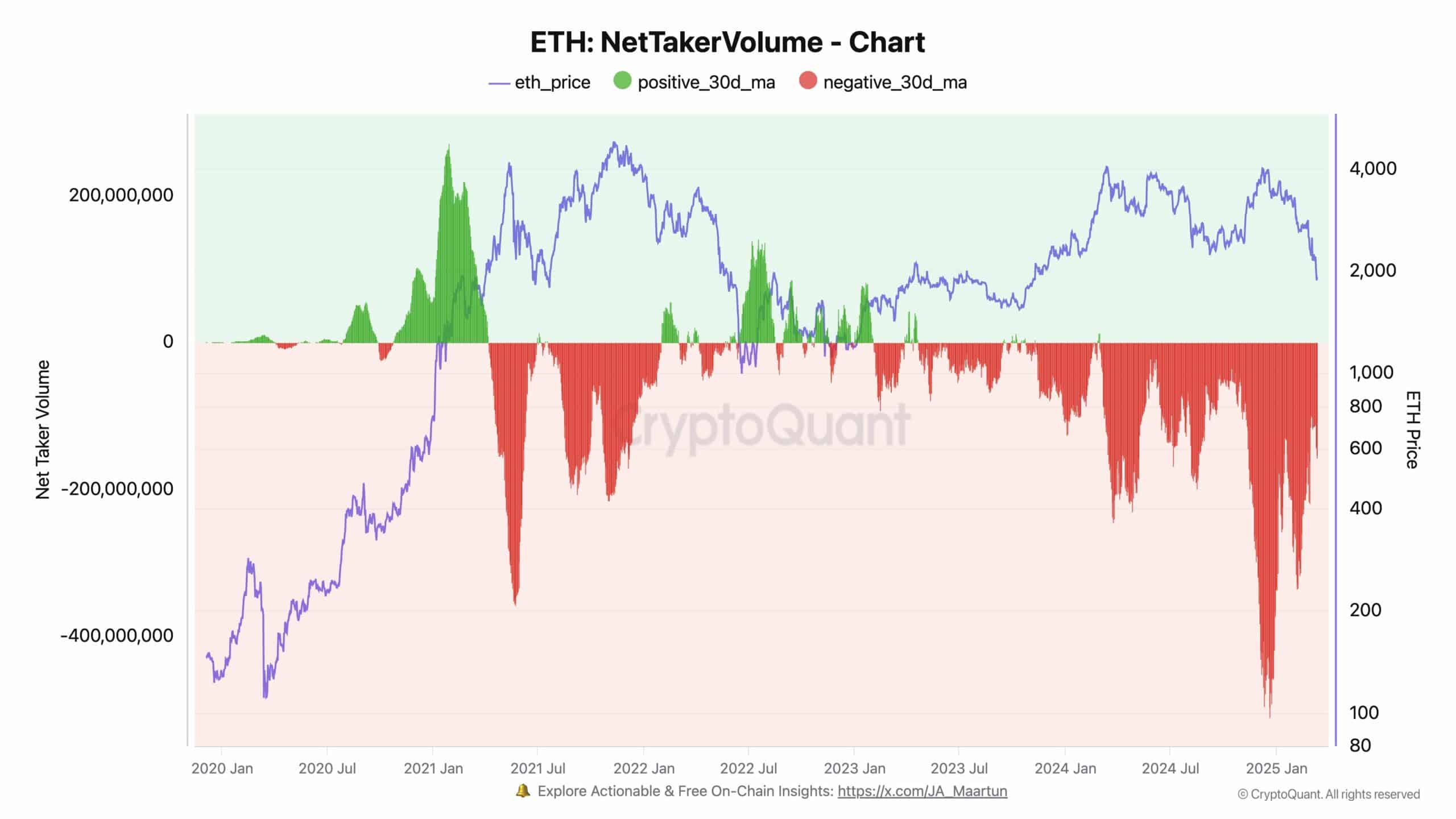

- Ethereum’s internet taker quantity remained deep within the pink, signaling sustained promote stress over the previous few months.

- Regardless of the promoting stress, the whole variety of ETH holders continued to extend, suggesting sturdy accumulation.

Ethereum [ETH] has witnessed a chronic interval of lively promoting stress, with internet taker quantity indicating sustained unfavourable momentum over the previous few months.

This development suggests aggressive sell-side dominance, sometimes related to declining market confidence or broader risk-off sentiment.

Regardless of this, the variety of ETH holders continues to climb, elevating questions on whether or not long-term buyers are accumulating amid the sell-off or if a value reversal is on the horizon.

Ethereum’s persistent promote stress

Information from CryptoQuant highlighted an prolonged part of aggressive promoting, with internet taker quantity displaying deep pink values.

Which means promote orders have dominated purchase orders, reflecting a bearish grip on Ethereum’s market construction.

Traditionally, such extended unfavourable taker quantity precedes main corrections or capitulation occasions, which might result in additional draw back if the development persists.

Supply: X

Taking a look at previous cycles, ETH has skilled related phases of intense promoting stress, adopted by a reversal when shopping for momentum re-emerges.

Nevertheless, the present development seems extra prolonged, suggesting that investor sentiment stays cautious regardless of broader crypto market developments.

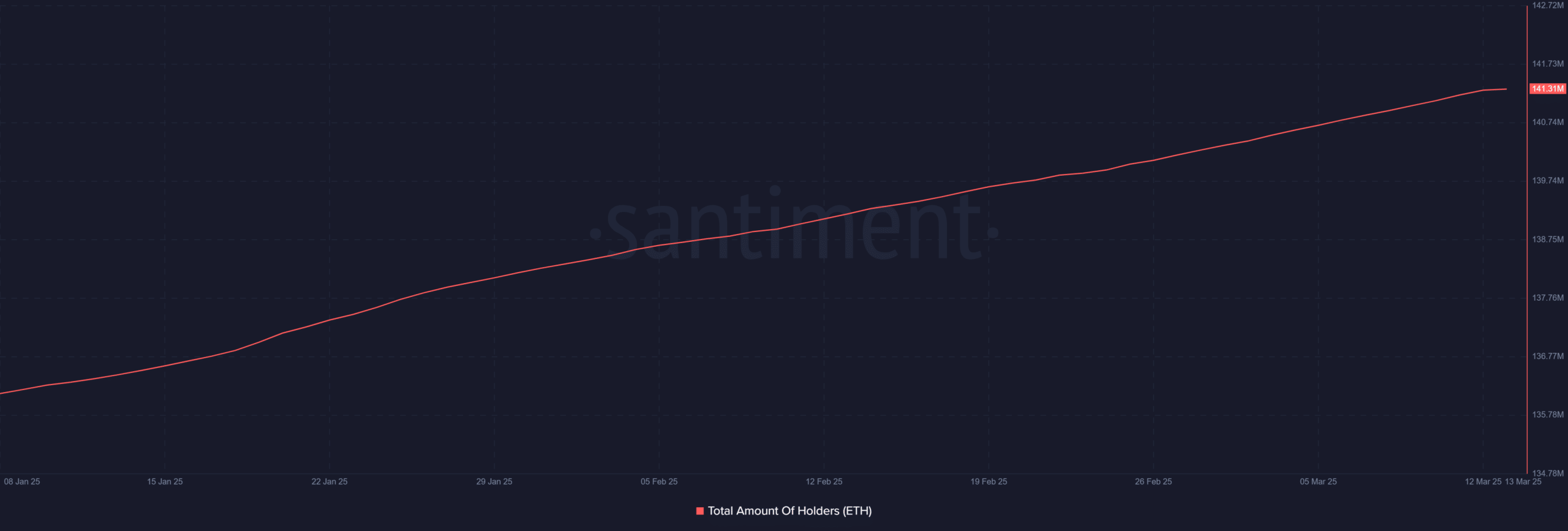

ETH holders proceed to develop

Whereas Ethereum’s value struggles, the variety of holders has been steadily growing.

On-chain knowledge from Santiment confirmed that complete ETH holders had reached roughly 141.31 million, marking constant progress regardless of the worth droop.

This implies that whereas short-term merchants have been exiting their positions, long-term buyers proceed to see worth in accumulating ETH at present ranges.

One potential clarification for this divergence is that institutional and whale buyers are steadily buying Ethereum whereas retail merchants capitulate.

This accumulation sample might set the stage for a possible restoration if promote stress subsides and broader market circumstances enhance.

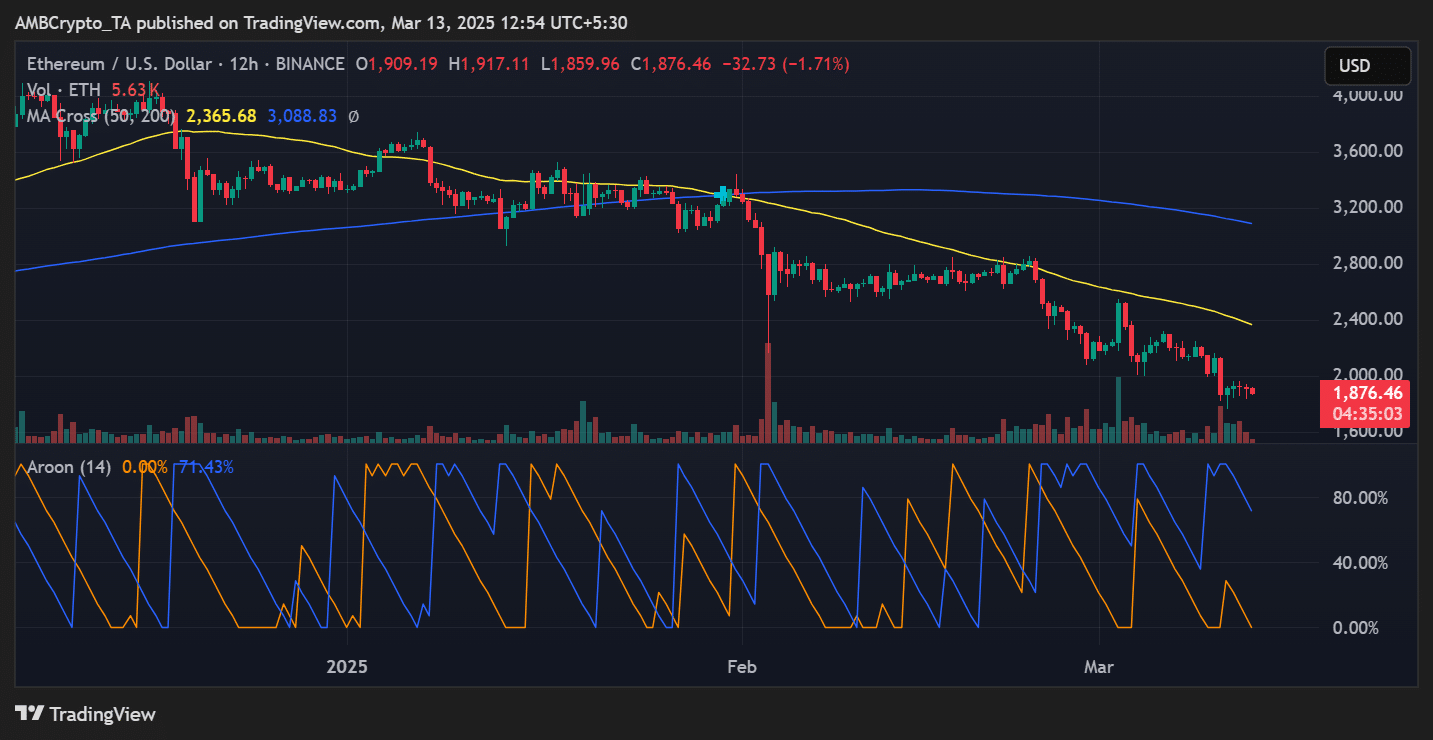

Value outlook: Will ETH discover help?

Ethereum was buying and selling at $1,876 at press time, having suffered a gentle decline over the previous few weeks. Key help ranges to look at included $1,850, which has traditionally served as an important demand zone.

If promoting stress intensifies, Ethereum might check the $1,750 area, a degree that beforehand acted as a powerful accumulation zone.

Conversely, if ETH manages to stabilize and reclaim the $2,000 mark, it might set off a shift in sentiment.

The Aroon indicator, which measures development power, at the moment alerts weak point, suggesting that ETH continues to be in a downtrend.

Nevertheless, a breakout above the 50-day shifting common [2,365] would point out renewed bullish momentum.

Conclusion

Ethereum’s market stays below promoting stress, as evidenced by sustained unfavourable internet taker quantity.

Nevertheless, the regular enhance in ETH holders alerts that some buyers view the present value vary as an accumulation alternative.

Whereas draw back dangers persist, a shift in sentiment or easing promote stress might place ETH for a restoration.

Merchants ought to watch key help and resistance ranges carefully, as Ethereum’s subsequent transfer will seemingly dictate broader market sentiment.