Coinspeaker

ETH News Today: Ethereum Price Bounce Eyes $3,000 amid Push for Staking in ETH ETF

Ethereum value

ETH

$2 683

24h volatility:

0.6%

Market cap:

$323.43 B

Vol. 24h:

$8.68 B

has bounced again as soon as once more in a broader crypto market restoration leaping all the way in which to $2,750 and eyeing additional rally above $3,000. The biggest altcoin has been underperforming for some time regardless of robust whale exercise and accumulation by Donald Trump‘s DeFi challenge – World Liberty Monetary.

On the month-to-month chart, the Ethereum value is down greater than 17% amid the broader crypto market turbulence. Regardless of, this, analysts proceed to be longing for ETH citing main positive aspects forward.

In keeping with knowledge from CryptoQuant, Ethereum’s realized value metric, which measures the common value at which all ETH was final transacted, presently stands at $2,263. This degree was reached on February 3 following a major market correction.

The realized value bands supply perception into Ethereum’s potential help and resistance ranges. The higher realized value band is 2.3 normal deviations above the realized value, whereas the decrease band is 0.5 normal deviations beneath it. Traditionally, Ethereum’s market cycle tops and bottoms have typically occurred close to these higher and decrease bands.

-

Supply: CryptoQuant

Ethereum Basis Allocates $53.4M to DeFi Initiatives Spark and Aave

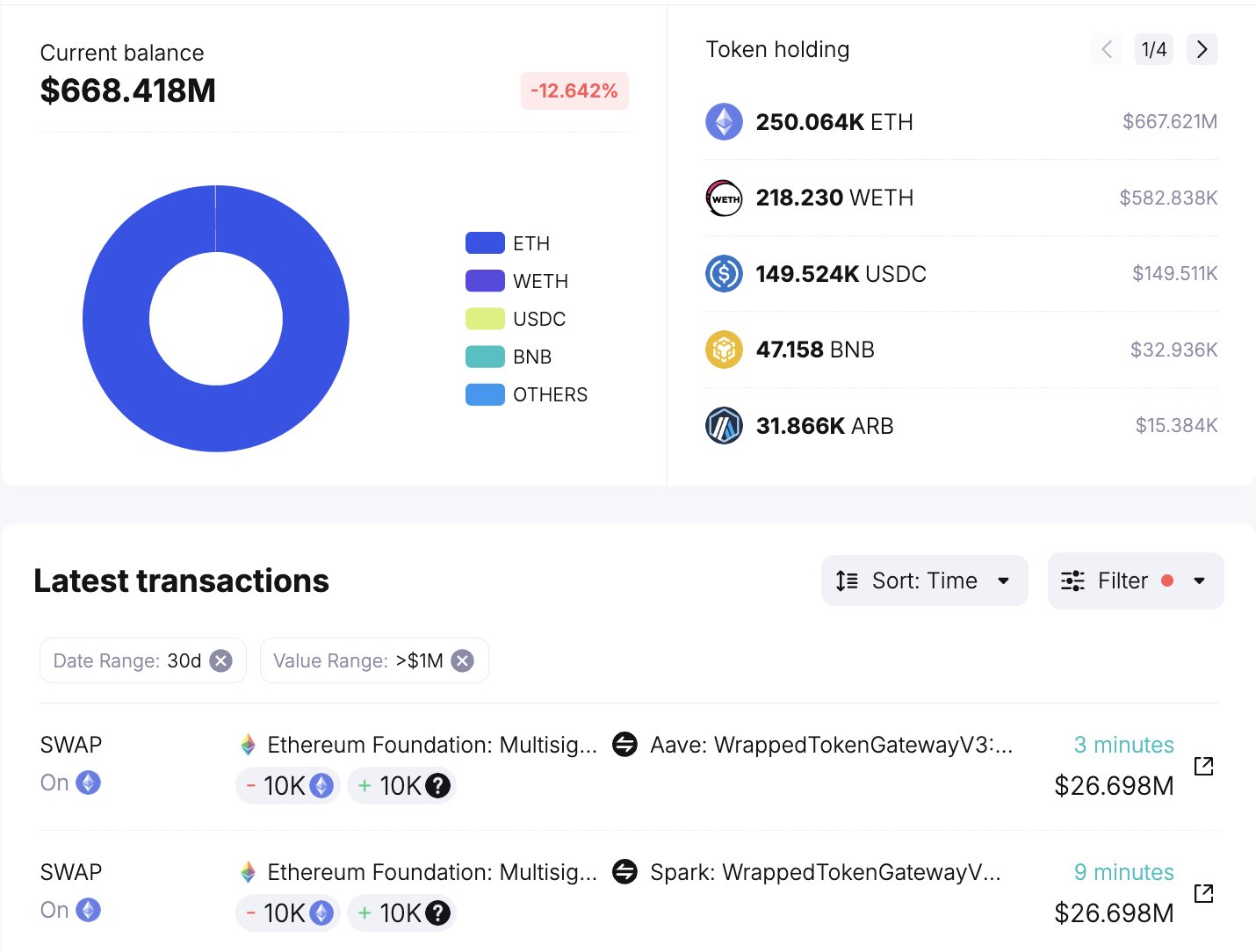

In one other improvement, the Ethereum Basis has been transferring a lot of ETH amid its try and foray into the DeFi ecosystem. As per the most recent on-chain knowledge, the Basis has transferred 10,000 ETH, price $26.7 million, every to DeFi tasks Spark and Aave. These transactions mark the inspiration’s first main strikes to deepen its engagement with DeFi platforms.

-

Supply: Spot On Chain

This strategic allocation underscores the inspiration’s dedication to supporting the expansion and adoption of DeFi. Each Spark and Aave are outstanding DeFi protocols, with Aave main in decentralized lending and Spark centered on enhancing blockchain-based monetary companies.

21Shares Information for Staked Ethereum ETF

On Wednesday, February 12, the Chicago Board Choices Change filed on behalf 21Shares to checklist a staked Ethereum ETF. The 19b-4 submitting by CBOE names the product “21Shares Core Ethereum ETF”, requesting for the staking facility on the Ethereum holdings of all US ETF issuers.

Talking on the event, Bloomberg ETF strategist James Seyyfart mentioned: “I consider that is the primary ETF to file with the SEC and request the flexibility to allow staking. The ultimate deadline for this submitting might be someplace across the finish of October”.

The upcoming product introduces a “point-and-click staking” characteristic, permitting ETH to stay securely in custody whereas incomes staking rewards. These rewards might be handled as earnings for the fund, leveraging trusted staking suppliers to make sure reliability.

Not like conventional “Staking-as-a-Service” fashions, the ETF takes a distinctly conservative strategy. It is going to completely stake ETH held by the Belief itself, avoiding any pooling with exterior entities. Moreover, it would chorus from promoting staking companies, promising particular returns, or subsidizing slashing dangers, making certain a simple and safe staking framework for buyers.

Final month in January, the US SEC, beneath the management of crypto mother Hester Peirce introduced the launch of a brand new crypto process drive devoted to bringing clear crypto regulation. Earlier, Peirce mentioned that staking might come to Ethereum ETFs beneath the brand new administration. It will make the funding product much more engaging for institutional gamers.

ETH News Today: Ethereum Price Bounce Eyes $3,000 amid Push for Staking in ETH ETF