Following the final buying and selling window, the US Bitcoin Spot ETFs have recorded one other week of overwhelming internet outflows with buyers pulling over $900 million from the market. This growth marks the fifth consecutive week of redemptions indicating weak market confidence amongst institutional buyers of the premier cryptocurrency.

Bitcoin Institutional Buyers Withdraw For The Fifth Straight Week

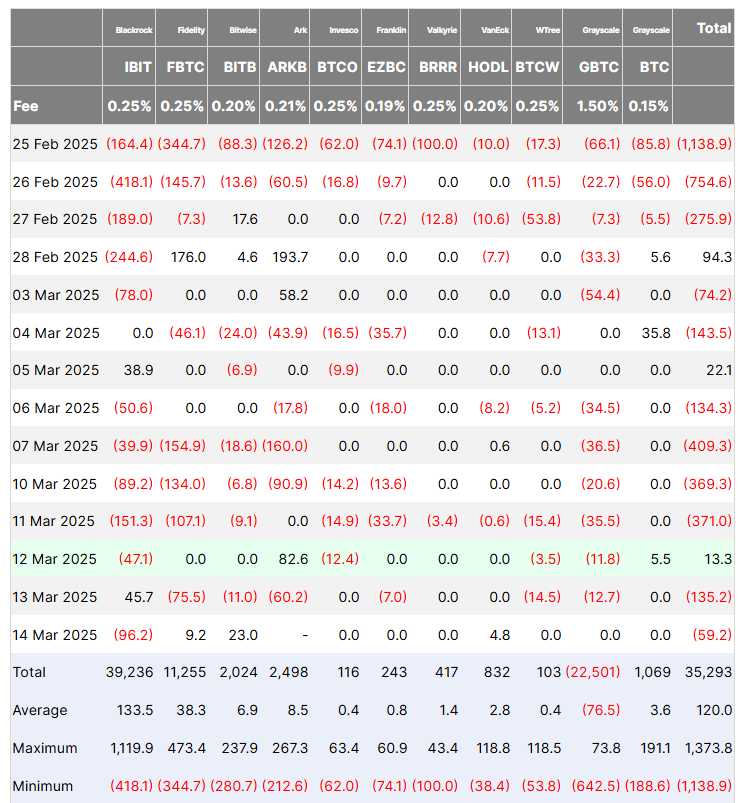

After a powerful begin to the 12 months which noticed the Bitcoin ETFs entice over $5 billion in investments, institutional buyers have proven a lot warning in current weeks indicated by large withdrawals. Based on data from Farside Investors, the Bitcoin Spot ETFs registered $921.4 million in internet outflows in the course of the previous week culminating in an estimated complete of $5.4 billion in the last five weeks.

The vast majority of withdrawals from final week have been pulled from BlackRock’s IBIT which recorded $338.1 million in internet outflows. Constancy’s FBTC adopted carefully with buyers with fund redemptions outpacing deposits by $307.4 million. Different Bitcoin ETFs reminiscent of Ark’s ARKB, Invesco’s BTCO, Franklin Templeton’s EZBC, WisdomTree’s BTCW, and Grayscale’s GBTC all noticed reasonable internet outflows between $33 million-$81 million.

In the meantime, Bitwise’s BITB, Valkyrie’s BRRR, and VanEck’s HODL all recorded minor internet outflows not higher than $4 million. Grayscale’s BTC emerged as the one fund to have a constructive displaying with internet inflows of $5.5 million.

The persistently excessive ranges of withdrawals from the Bitcoin ETFs could be related to the current BTC market value correction. During the last month, the maiden cryptocurrency has skilled a value decline of 11.95% reaching ranges as little as $77,000. Throughout this era, institutional buyers have proven a lot warning, with the entire internet property of the Bitcoin Spot ETFs reducing by 21.70% to $89.89 billion based on data from SoSoValue.

Ethereum ETFs Lose $190 Million In Withdrawals

Amidst the Bitcoin ETFs’ struggles, the Ethereum Spot ETFs market is experiencing related investor sentiment following internet outflows of $189.9 million within the final week. This growth marks the third consecutive week of withdrawals, bringing the entire internet outflows to $645.08 million inside this era.

Much like its Bitcoin counterpart, BlackRock’s ETHA skilled the biggest withdrawals of the previous week valued at $63.3 million. On the time of writing, complete cumulative inflows into the Ethereum ETF market are valued at $2.52 billion with complete internet property standing at $6.72 billion i.e. 2.90% of the ETH market cap.

In the meantime, Ethereum continues to commerce at $1,924 reflecting a 0.73% acquire up to now 24 hours. However, Bitcoin is valued at $84,009 with no vital value change on its day by day chart.