- There was a major fall in BTC outflows after hitting a brand new withdrawal level

- Liquidity inflows into Coinbase correlated with traders’ shopping for motion within the spot market

Bitcoin, the world’s largest cryptocurrency, is continuous to commerce at ranges properly beneath its all-time highs. In reality, losses might be seen throughout the board, with the cyrpto valued at simply over $81,000, at press time, after a 24-hour decline of virtually 2%.

Now, with Bitcoin buying and selling near its essential assist ranges on the chart, spot merchants have regularly begun to build up the asset. Therefore, it’s price analyzing different components to find out whether or not BTC will see a value pump within the coming days or not.

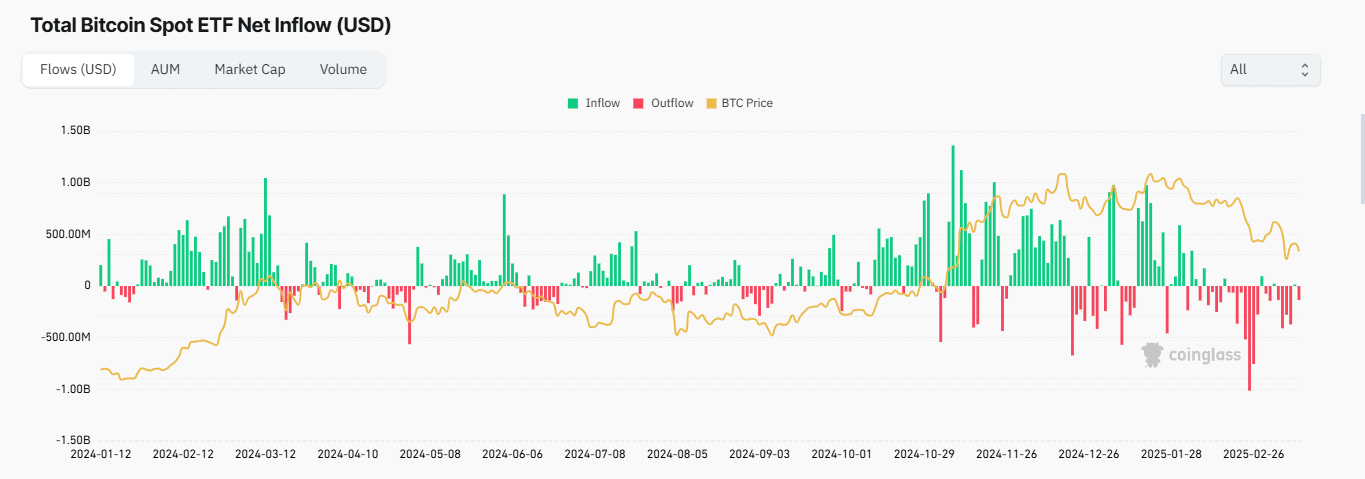

Spot ETF outflows decelerate

Current information revealed a major fall in BTC outflows from exchange-traded funds (ETFs) over the previous month.

On the time of writing, after Bitcoin peaked with outflows of $1.01 billion on 25 February – with complete Bitcoin gross sales of $2.039 billion between 25-27 February 25 – investor promoting strain cooled down.

Within the final 24 hours alone, $135.20 million was withdrawn from the market, with property underneath administration at $97.62 billion – A considerably excessive quantity.

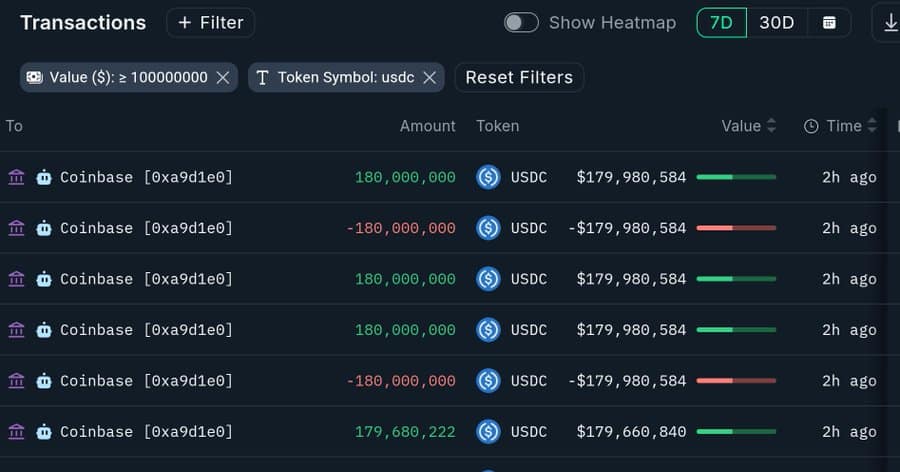

Whereas promoting in BTC Spot ETFs has slowed down, there have been huge liquidity inflows into Coinbase.

Over the past seven days alone, inflows have totaled 719 million USDC. Such a big influx right into a cryptocurrency trade, whereas value stays stagnant, is an indication of ongoing accumulation. This could additionally counsel that individuals are shopping for in anticipation of a rally.

A have a look at Bitcoin’s trade netflows on Coinglass confirmed this shopping for exercise. Particularly as spot merchants bought roughly $57 million price of BTC within the final two days, turning trade netflows destructive.

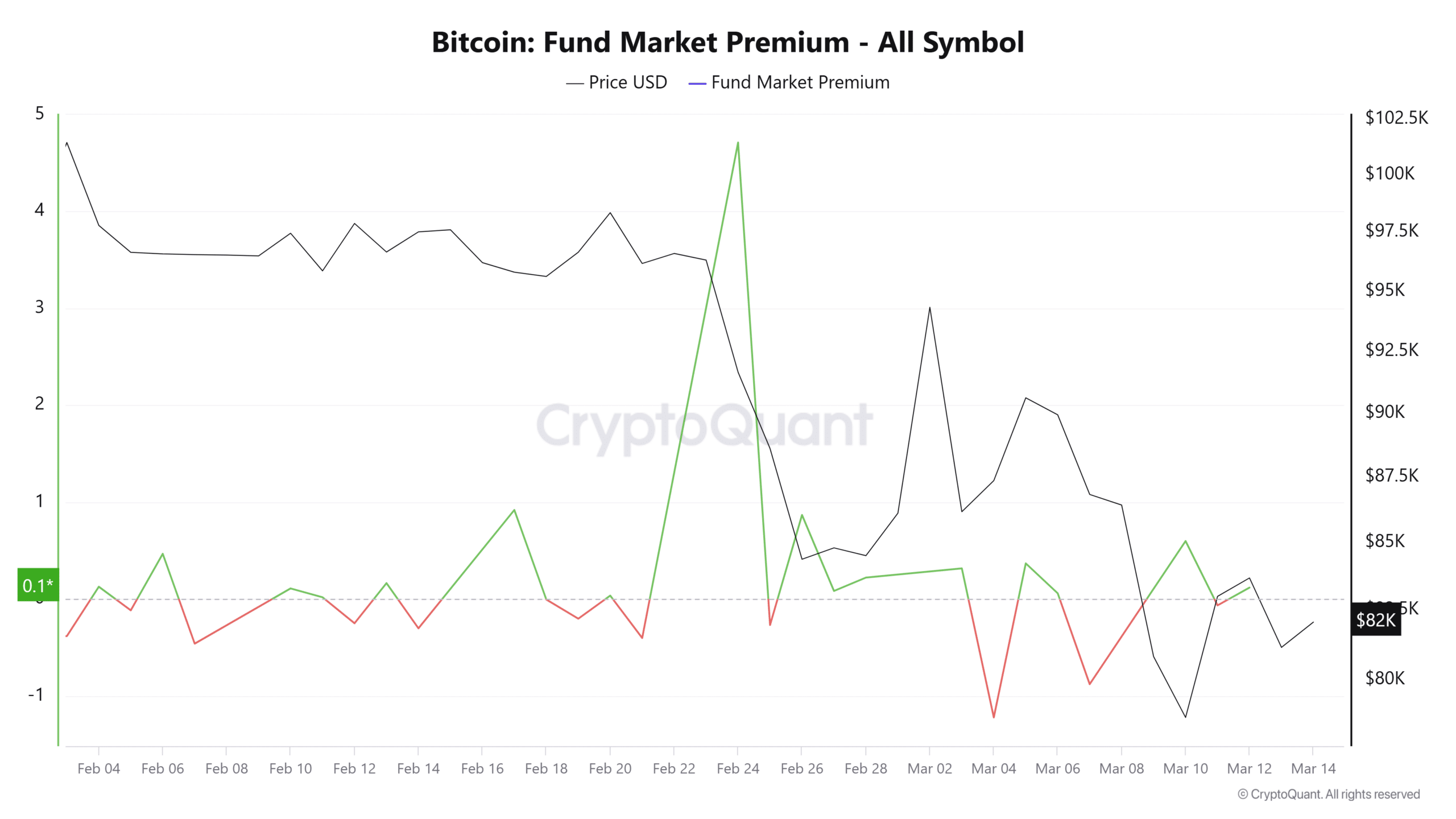

Adverse netflows imply that merchants are shopping for an asset. Institutional traders appeared to share an analogous sentiment, because the funds market premium turned constructive. It had a studying of 1.03, at press time.

Right here, it’s price declaring that the funds market premium measures institutional demand and provide for BTC.

A studying above 1 signifies shopping for, whereas a destructive studying confirms promoting.

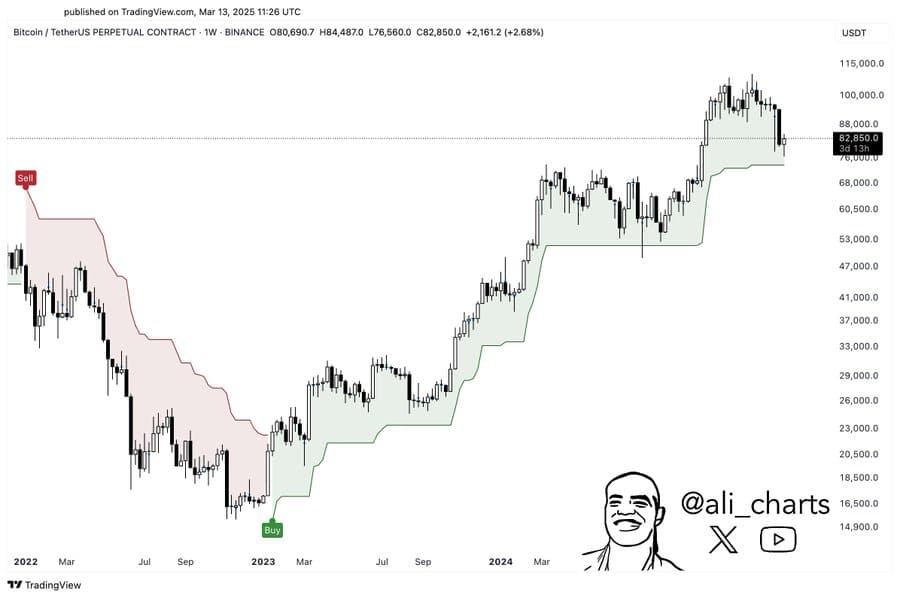

Weekly assist stays a key issue

Whereas Bitcoin has been regaining energy available in the market, hinting at a doable rally, market sentiment may shift. If this occurs, the subsequent notable assist degree could be at $74,000.

This assist degree has held agency since January 2023 and has been a basis for market rallies. If the worth reacts positively and traits greater from this degree, it may sign a serious Bitcoin rally. Nevertheless, a breach of this assist may point out excessive bearish sentiment, resulting in additional value declines.

For now, the market stays well-positioned for an upswing, offered bullish sentiment continues to dominate.

![Bitcoin [BTC] accumulation rises as ETF outflows cool – Is a breakout coming?](https://krypto4u.com/wp-content/uploads/2025/03/Abdul_Bitcoin-1000x600.webp-750x375.webp)